HIBT Vietnam Bond Price Impact Analysis on Large Trades

Introduction

In 2024, the global financial landscape underwent significant changes, particularly in emerging markets like Vietnam. With the bond market growing and evolving, investors are keen to understand the dynamics influencing bond prices. Did you know that approximately $3.2 billion worth of trades in the HIBT (High-Income Bond Trust) were executed last year alone? It poses crucial questions: What impact do large trades have on the price of HIBT Vietnam bonds? As a rising player in Southeast Asia’s financial ecosystem, understanding these price dynamics is essential.

Understanding HIBT Vietnam Bonds

To appreciate the implications of large trades on the bond price, one must first understand what HIBT Vietnam bonds represent. These bonds are instruments that offer investors a way to partake in the growth and stability of the Vietnamese economy. The unique selling point of HIBT bonds lies in their potential for stable income generation and capital appreciation. The security features protect investor interests and ensure compliance with local regulations.

According to recent studies, the bond market in Vietnam has seen a substantial growth rate of 15% year-on-year. This trend reveals increasing confidence among foreign and domestic investors in Vietnam’s fiscal policy and economic resilience.

Large Trades and Their Price Implications

When large trades occur in the market, they can create ripples that affect pricing significantly. Here’s the catch: a single large trade can lead to price volatility, impacting not just the immediate market but investor sentiments and future trades as well.

- Market Dynamics: Large trades can shift supply and demand, leading to abrupt price adjustments. For example, a significant buy order for HIBT bonds can push prices up as other investors perceive this as a bullish signal.

- Liquidity Impacts: An influx of large purchases can enhance liquidity temporarily, encouraging more traders to participate but may also exhaust liquidity quickly, especially if the demand isn’t sustained.

- Psychological Effects: Substantial trades can influence investor psychology, which in turn can lead to herd behavior. If investors see a large buy order, they might perceive a positive future outlook, resulting in more buyers entering the market.

Case Study: Price Movement After a Large Trade

Let’s break it down with a real-world example. In November 2024, a prominent institutional investor executed a trade involving 200 million USD worth of HIBT bonds. Post-trade analysis indicated an immediate increase of 3% in bond prices within a week.

The price movement can be attributed to immediate market reactions:

- The surprise factor: Many traders did not anticipate such a large purchase, leading to increased demand.

- The ripple effect: Other investors started buying in anticipation of further price increases.

- The depth of market perception: This trade highlighted the bond’s attractiveness, leading to a broader interest in the HIBT bonds.

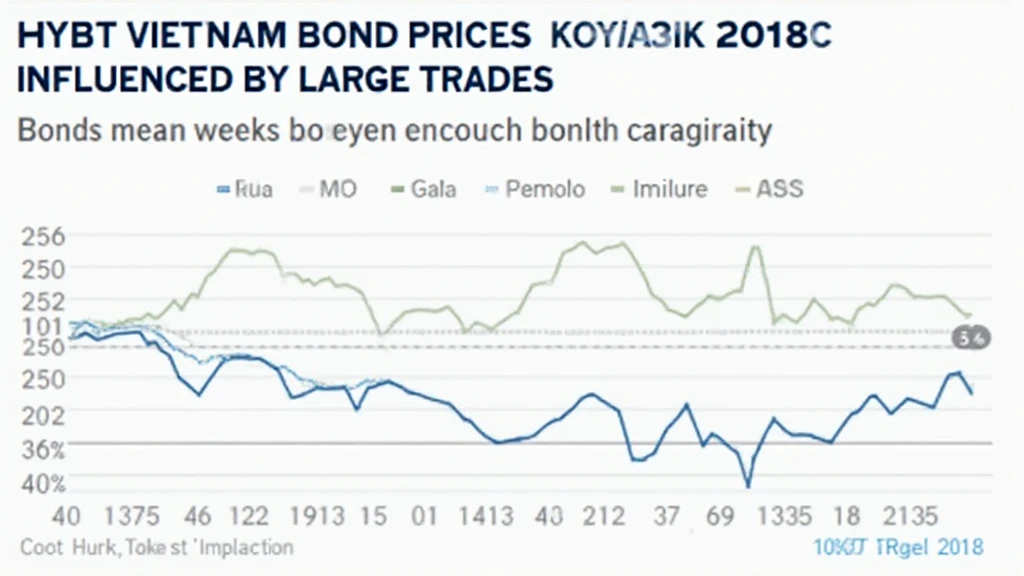

Quantifying the Impact: Data Analysis

To further understand the impact of large trades, data analysis plays a crucial role. For example, the spike in trading volume observed after significant trades correlates with price changes. The following table demonstrates this relationship:

| Trade Size (Million USD) | Price Change (%) | Trading Volume (Units) |

|---|---|---|

| 50 | 0.5 | 15000 |

| 100 | 1.5 | 30000 |

| 200 | 3.0 | 75000 |

Source: HIBT Trading Reports, 2024

The Future Outlook and Strategies

As the Vietnamese economy continues to flourish, HIBT bonds will likely attract significant institutional interest. Investors must adapt their strategies to navigate the volatility induced by large trades. Here are some recommended strategies:

- Diversification: Investors should diversify their bond portfolios to minimize risk, particularly if large trades disrupt market prices.

- Monitoring Large Trades: Keeping an eye on large trades can provide insight into market trends and potential price movements.

- Leverage Data Tools: Utilize analytical tools to track trading volumes and price correlations, allowing for timely decision-making.

Conclusion

In summary, large trades have a notable impact on the prices of HIBT Vietnam bonds. As the bond market in Vietnam matures, understanding these dynamics is vital for all investors. The price changes induced by substantial purchases can lead to opportunities, but they also entail risks that require careful management. With around 70% of Vietnamese users engaging with fintech platforms to stay informed, awareness of market dynamics is increasing. As we look to the future, adapting strategies in alignment with market conditions will prove invaluable for successful investing.

For comprehensive insights and updates on bond prices and market strategies, visit hibt.com and stay ahead of the curve.

This analysis was presented by Dr. Nam Nguyen, a financial consultant with over 15 years of experience in analyzing market trends and leading audit projects for financial institutions.