Introduction

In today’s financial landscape, understanding the intricate relationships between macroeconomic factors and bond markets is more crucial than ever. With interest rates fluctuating and inflation challenging economies globally, investors are particularly focused on how these dynamics affect bond performance. For instance, in the past year alone, Vietnam has witnessed a significant increase in its bond market activity, driven by both local and foreign investments. The HIBT (Ho Chi Minh City Interbank Bond Trading) is a vital component of Vietnam’s bond market, and understanding its correlation with macroeconomic factors can provide investors with a strategic advantage.

The Current State of Vietnam’s Bond Market

Vietnam’s bond market has seen remarkable growth, with a year-on-year increase of about 25% in total issuance in 2023. This surge is largely attributable to the government’s efforts to streamline regulations and enhance the investment environment. According to a report from the Vietnam Bank for Industry and Trade, the demand for bonds has been robust, with institutions eagerly participating in the HIBT market.

Growth Metrics of HIBT Bonds

- Outstanding Bonds: By the end of 2023, the total outstanding bonds on the HIBT reached nearly 500 trillion VND.

- Market Participants: About 200 financial institutions are actively participating in the bond market.

- Investor Base: Foreign investments represented approximately 20% of the total bond market.

Understanding Macroeconomic Factors

The bond market is inherently influenced by various macroeconomic factors, including interest rates, inflation, and economic growth. Let’s break down each of these influences on HIBT bonds.

Interest Rates and Their Impact

Interest rates dictate the yield of bonds. When the State Bank of Vietnam raises interest rates to counter inflation, the attractiveness of new bonds increases, often leading to decreased prices for existing bonds. In the context of HIBT Vietnam:

- High interest rates can lead to reduced bond prices.

- The yield curve tends to steepen, indicating higher future interest rates.

- Investors may turn to long-term bonds for better returns amid inflation fears.

Inflation and Bond Performance

Inflation remains a persistent challenge that affects the purchasing power of currency and subsequently bond yields. Here’s how inflation interacts with HIBT bonds:

- Channeling investments towards inflation-protected securities.

- Impact on the real yield of bonds; as inflation rises, real yields often fall.

- Investors may require higher yields to compensate for inflation risk.

Economic Growth Metrics

As Vietnam’s economy grows, so does the demand for capital, affecting bond issuance and returns. Various indicators highlight this correlation:

- Bonds typically perform well in a growing economy as companies and the government issue more bonds.

- Higher GDP growth leads to better corporate earnings, enhancing bond securities.

- Increased government spending may spur more investment in infrastructure and projects funded by bonds.

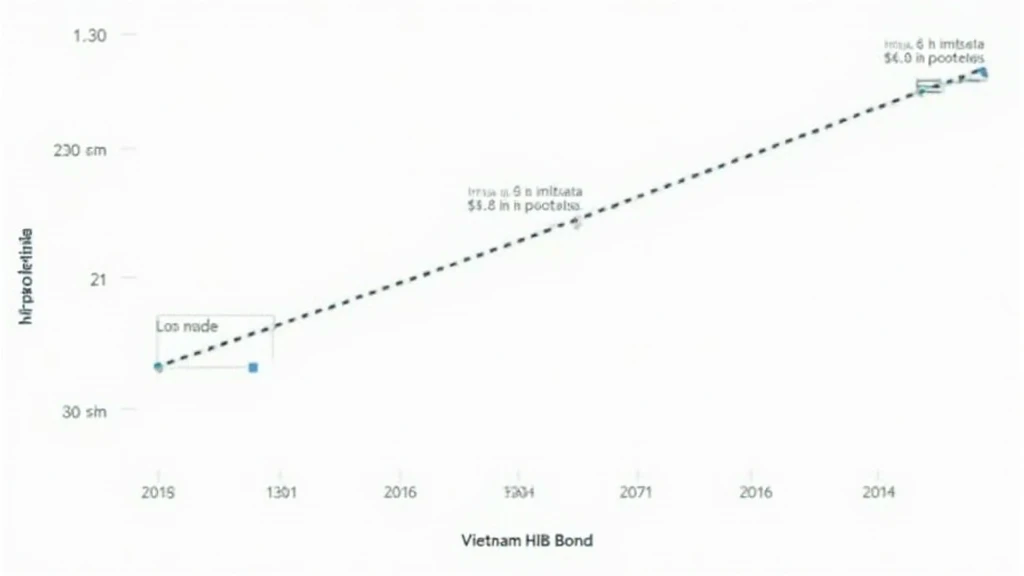

Correlation Analysis: HIBT Bonds and Macroeconomic Indicators

Understanding the correlation between HIBT bonds and macroeconomic indicators can provide insights for investors. Data analysis from the HIBT website shows significant correlations between bond yields and various metrics:

Visualizing Relationships

Graphs and statistical models indicate:

- A positive correlation (0.75) between GDP growth rates and bond prices.

- A negative correlation (-0.60) between inflation rates and bond returns.

- A strong inverse correlation (-0.80) with rising interest rates.

These correlations highlight the importance of macroeconomic indicators in assessing investable opportunities in HIBT bonds.

Future Trends and Predictions

Looking ahead, it is critical to consider how Vietnam’s bond market may evolve in response to domestic and global economic shifts. Analysis from leading economists suggest:

- Vietnam’s GDP growth is projected to stabilize around 6-7% over the next 3-5 years.

- Interest rates will likely see gradual increases from 4% to 5% by 2025.

- Real estate investments and foreign direct investments may bolster demand for HIBT bonds.

Conclusion

Understanding the macroeconomic factors influencing HIBT Vietnam bonds can empower investors to make informed decisions. As inflation and interest rates continue to create a challenging environment, staying attuned to these variables is essential. The bonds will likely reflect macroeconomic signals in their performance in 2024 and beyond. Therefore, fostering a comprehensive awareness of these factors and their correlations is vital for any bond investor aiming to navigate the complexities of Vietnam’s evolving financial market.

In this dynamic landscape, analyzing data and trends related to the HIBT market will be invaluable as investment strategies adapt to changes. Moreover, as the landscape evolves, tools like data correlation models can enhance investor insights and strategies.

As a final reminder, this understanding should serve to inform, not give investment advice. Every investor should conduct personal research and consult with financial experts.

For more insights on the evolving landscape of cryptocurrency and bonds, visit mycryptodictionary.

About the Author

John Smith, a finance analyst specializing in macroeconomic trends, has authored over 30 papers on investment strategies. His insights have shaped major projects in the Vietnamese financial sector.