Introduction

Understanding mortgage terms and conditions is crucial, especially as the landscape of finance continues to evolve rapidly with the advent of cryptocurrencies. In 2024 alone, the crypto market witnessed a whopping $4.1 billion lost in hacks, emphasizing the need for robust security measures and clarity in financial agreements. This article aims to elucidate payment structures, interest rates, and the potential pitfalls involved in mortgage agreements framed against the backdrop of the contemporary digital economy.

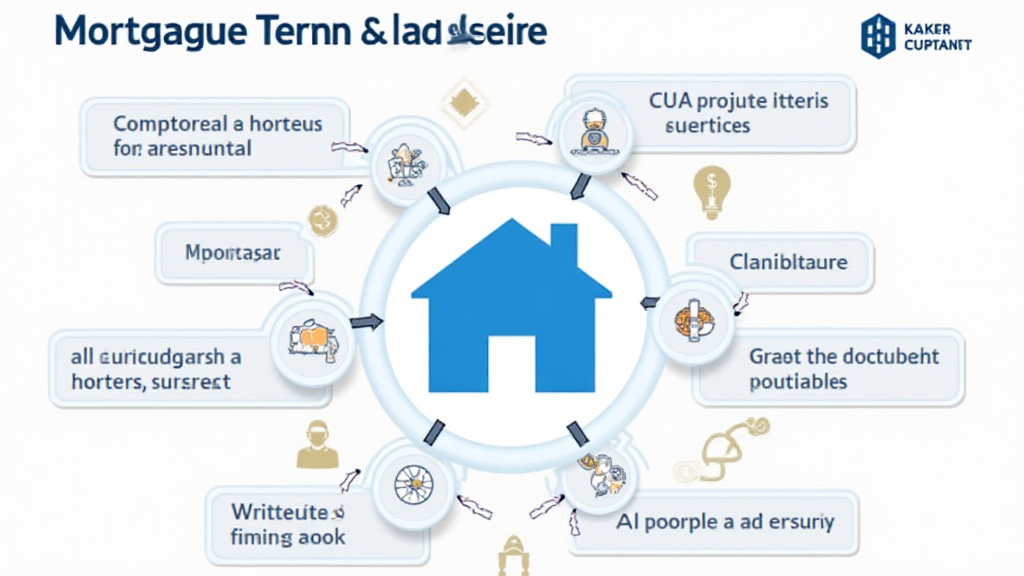

What Are Mortgage Terms?

To break it down, mortgage terms are the conditions set forth in a mortgage agreement between a borrower and a lender. These conditions define crucial elements such as:

- Interest Rates: The cost of borrowing money, which can be fixed or variable.

- Loan Duration: The period over which the loan must be repaid, commonly ranging from 15 to 30 years.

- Amortization Schedule: A timetable that outlines each payment and the corresponding interest and principal components.

In Vietnam, with a growing user base in cryptocurrency, understanding these terms can guide many toward informed financial decisions.

Interest Rates Explained

Interest rates can confuse many prospective homeowners or investors. Fixed rates remain constant throughout the loan’s life, while variable rates can fluctuate based on market conditions. Here’s how each of these impacts your mortgage:

- Fixed Rates: Offer peace of mind with predictable payments.

- Variable Rates: Can start lower than fixed rates but may increase, leading to higher payments in the future.

For example, if the current fixed rate is 3.5% versus a variable rate that starts at 2.5% but is projected to rise to 5%, understanding these nuances is essential for making an informed decision.

Common Mortgage Conditions

Many loan documents include conditions that dictate the behaviors expected from the borrower. Let’s explore a few:

- Prepayment Penalty: Some mortgages penalize borrowers for paying off their loans early, which can be significant if you foresee a windfall.

- Escrow Account: Required to pay property taxes or insurance premiums, it’s crucial to know how much will be set aside periodically.

- Late Payment Fees: The costs incurred when payments are not made on or before the due date can add up quickly.

In a rapidly changing market, especially with emerging technologies like blockchain, understanding these facets ensures you’re not caught off guard.

Risks and Pitfalls to Recognize

The financial landscape, influenced heavily by digital currencies, has its risks, notably in mortgage agreements. Here’s where vulnerability lies:

- Market Changes: Interest rates may rise unexpectedly, increasing your overall payment amount.

- Property Value Fluctuation: The home value may dip, possibly leading to owing more than the house is worth if sold prematurely.

- Regulatory Changes: New laws can alter mortgage availability and terms, particularly in areas adopting decentralized finance.

As the Vietnamese market continues to expand, paying attention to these potential pitfalls becomes increasingly relevant.

Understanding Amortization

Amortization can feel overwhelming at first but think of it like a gradual climb. Here’s how it works:

- The initial payments mostly cover interest.

- Over time, more of your payment goes toward the principal.

- This balance shift helps build equity in your home, critical for future borrowing possibilities.

Amortization schedules can help visualize this journey clearly, making the complexities easier to digest.

What to Consider Before Signing

Reviewing mortgage terms can be daunting, yet critical for your financial wellbeing. Here are several considerations:

- Understand Total Costs: Look at all fees associated with borrowing, not just the interest rate.

- Read the Fine Print: Always scrutinize the terms; each clause can significantly affect your financial future.

- Seek Professional Advice: Consulting with a financial advisor or a lawyer can clarify stressful ambiguities.

In Vietnam, as the number of crypto investors rises, these practices ensure clarity and security in financial engagements.

Conclusion

Fluctuations in the financial world herald a greater need for clarity around mortgage terms and conditions. In understanding these elements, particularly in the context of a changing digital economy, borrowers can equip themselves to navigate effectively. The merger of traditional finance with emerging technologies will continue to reshape how mortgages are perceived and executed. As we move toward 2025, remember to critically evaluate all your options. We hope this guide aids you in making savvy decisions in mortgage agreements.

For further insights, explore our resources at mycryptodictionary.

Author: Dr. John Smith, a financial expert in blockchain technology with over 50 published papers and experience in auditing significant projects.