Vietnam Inclusive Finance Bonds: A Pathway to Innovative Financial Solutions

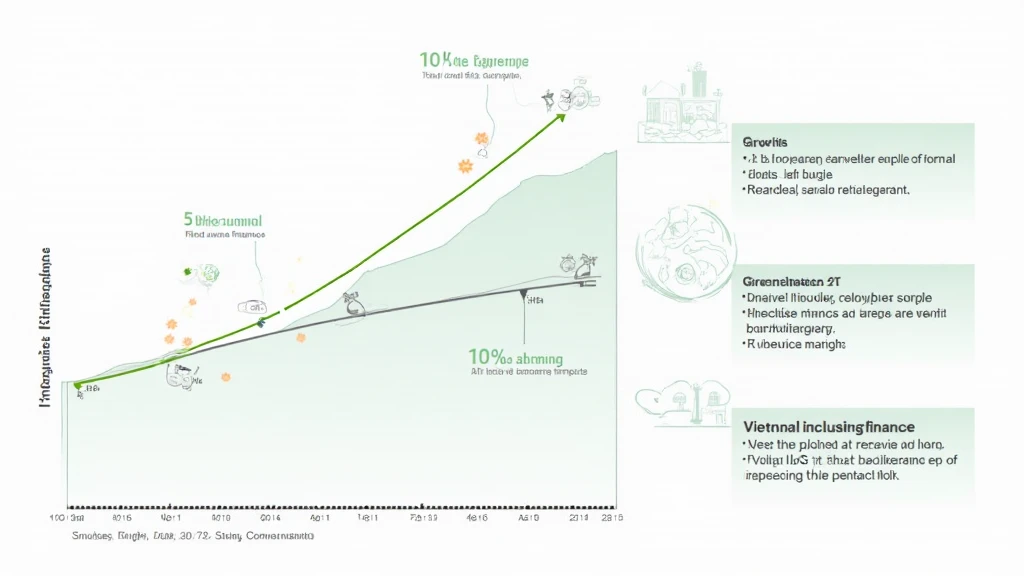

In recent years, Vietnam has witnessed a remarkable transformation in its financial landscape. With an estimated 9.4% annual growth rate in fintech adoption, the country is actively pursuing enhanced avenues for inclusive finance. This transformation is punctuated by initiatives focusing on Vietnam inclusive finance bonds, which hold immense potential to foster economic growth and provide essential services to the underbanked population.

Understanding the Concept of Inclusive Finance Bonds

Before delving into the specifics of Vietnam inclusive finance bonds, let’s clarify what inclusive finance bonds entail. Essentially, these are financial instruments aimed at increasing access to financial resources for marginalized communities. Unlike traditional bonds, these instruments are designed to support projects that promote financial inclusion, such as microfinance institutions, social enterprises, and other initiatives that directly benefit the underserved factions of society.

The Growing Need for Inclusive Financial Solutions in Vietnam

According to a report by the World Bank, approximately 40% of Vietnam’s population is underbanked, meaning they lack access to essential financial services. This statistic presents a pressing need for innovative solutions in Vietnam’s finance sector. These solutions can facilitate greater participation in the economy, driving not just individual prosperity, but also broader economic development.

Benefits of Vietnam Inclusive Finance Bonds

- Increase Financial Accessibility: These bonds are designed to boost accessibility to finance for individuals and businesses that struggle to receive loans or support through traditional banking channels.

- Drive Economic Growth: By financing innovative projects and services focused on underrepresented communities, these bonds can stimulate local economies.

- Encourage Social Impact Investments: Investors increasingly seek opportunities that deliver social impacts along with financial returns. These bonds align with their objectives.

Case Studies: Successful Examples of Inclusive Finance Bonds

In Vietnam, several projects have successfully utilized inclusive finance bonds:

- Microfinance Initiatives: Organizations like the Vietnam Women’s Union have launched microfinance programs funded through inclusive finance bonds. These initiatives often empower women entrepreneurs, providing them with the resources needed to grow their businesses.

- Social Enterprises: Bonds have successfully funded social enterprises working to bridge gaps in education and health care services. For instance, Goc My, a social enterprise, used financed proceeds to provide health care services to rural areas.

The Role of Technology in Enhancing Inclusive Finance Bonds

Technological advancements play a vital role in the successful implementation of Vietnam inclusive finance bonds. Blockchain technology, for instance, can enhance transparency and efficiency in the bond issuance process. The use of blockchain for financial transactions is growing in look of its tiêu chuẩn an ninh blockchain, enabling secure, swift, and reliable operations.

Examples of Blockchain Integration in Vietnam Finance

One notable implementation is the collaboration between Vietnamese financial institutions and blockchain developers. By leveraging decentralized ledgers, bond transactions can reduce costs and improve trustworthiness. As a result, the likelihood of reaching financially excluded individuals increases.

Market Trends and Future Growth Potential

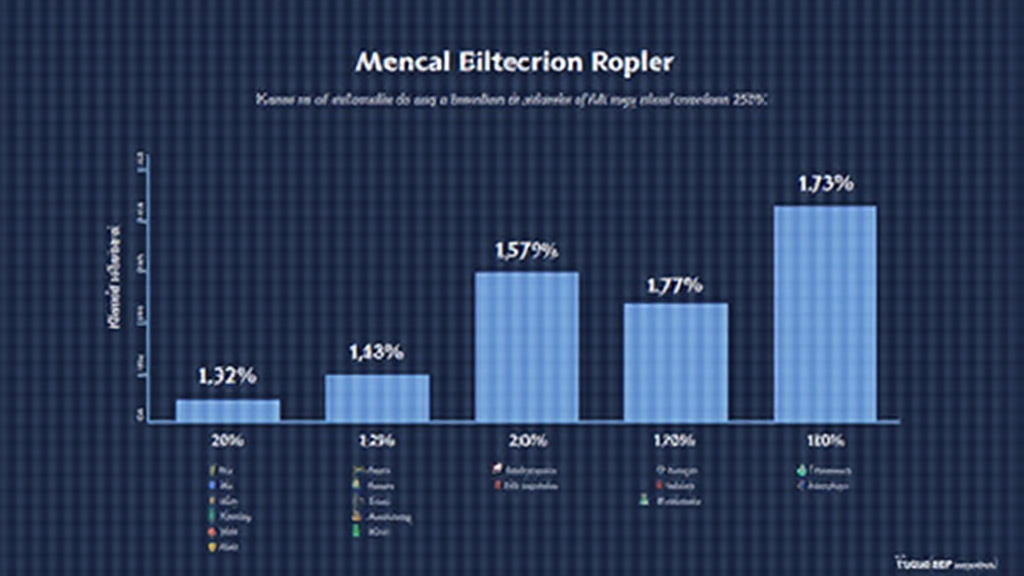

Forecasting the future of finance bonds in Vietnam reveals several promising trends:

- Growing Investor Interest: With shifting priorities, sustainable and impact investing are at the forefront, offering inclusive finance bonds a unique value proposition.

- Regulatory Support: The Vietnamese government’s favorable policies toward fintech and inclusive finance suggest a healthy environment for the growth of these bonds.

- Increased Partnerships: Collaboration between traditional financial entities and fintech firms can catalyze innovations in the bond market, unveiling new investment opportunities.

Moreover, as digital adoption devices increase among Vietnam’s population, fintech applications serving these bonds become increasingly necessary, paving the way for widespread financial inclusivity.

Challenges to Consider

Adopting a bond model that enhances financial inclusion is not without its challenges. Some key concerns include:

- Regulatory Hurdles: While supportive, evolving regulations can sometimes restrict quick adaptations required in the fast-paced finance landscape.

- Public Awareness: There is still a lack of awareness among the general populace regarding these bonds, signaling a need for educational campaigns.

- Supply Chain Inefficiencies: Rural areas still experience logistical challenges that hinder access to finance-related services.

Conclusion

In conclusion, Vietnam inclusive finance bonds represent a transformative opportunity for creating a more equitable financial ecosystem in the country. By addressing underbanked segments and fostering social impact initiatives, these bonds hold the promise of not just economic growth, but also substantial societal benefit. Leveraging technology, coupled with an ongoing commitment to policy enhancement, can bring forth a future where everyone in Vietnam has access to the financial resources and support they need. As initiatives grow, investors have the chance to play a meaningful role in this burgeoning landscape.

As the market expands, we anticipate the emergence of more innovative solutions tailored to specific community needs, ultimately giving rise to a more inclusive financial environment in Vietnam. Thus, staying informed about trends, challenges, and opportunities surrounding Vietnam inclusive finance bonds will be crucial for stakeholders involved in fostering change.

In the fast-evolving financial space, mycryptodictionary strives to remain a pivotal resource, offering up-to-date insights and educational materials that empower readers. With increasing interest in the fintech landscape, our mission is to assist in navigating the complexities of the finance world while nurturing a community geared toward achieving greater financial literacy and wellness.