HIBT Bond Order Book Analysis in Vietnam: A Deep Dive

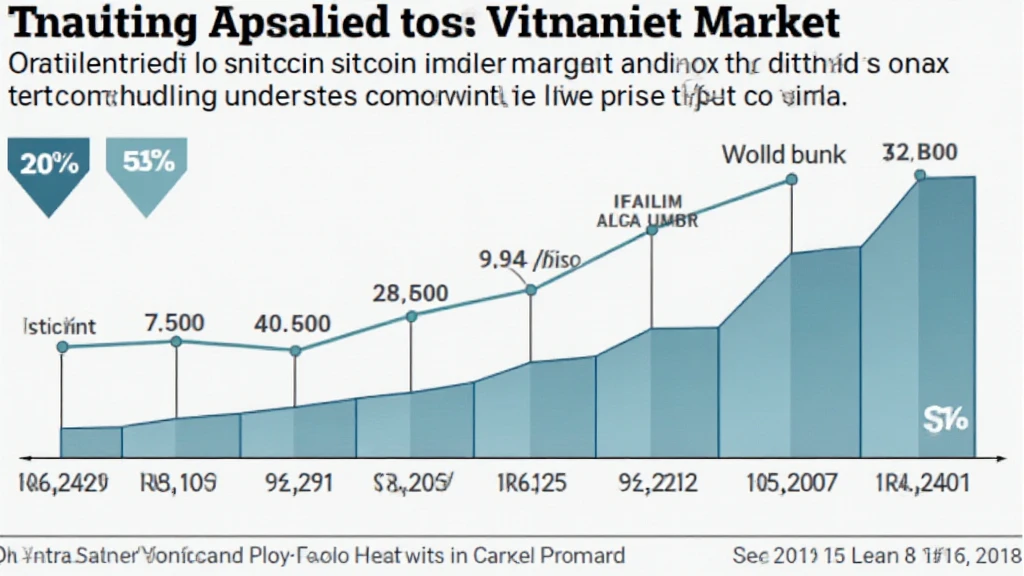

As the cryptocurrency market evolves, more sophisticated tools are needed to navigate its complexities. One such tool is the bond order book analysis, specifically within the context of HIBT transactions. In Vietnam, where the number of cryptocurrency users has seen remarkable growth—reportedly rising by 13% in the past year—the need for effective analytical frameworks is critical.

This article aims to provide a deep dive into the HIBT bond order book analysis in Vietnam, highlighting its importance and providing insights useful for investors, analysts, and regulators alike.

Understanding Bond Order Books

To appreciate the significance of bond order book analysis, we must first understand what a bond order book is. In essence, it acts like a traditional marketplace, where buy and sell orders are listed for a specific type of digital asset, in this case, the HIBT bonds in Vietnam.

- Bid Order: The maximum price a buyer is willing to pay for an asset.

- Ask Order: The minimum price a seller is willing to accept to sell the asset.

- Order Depth: The total quantity of buy and sell orders available at different price levels.

Like a bank vault securing physical assets, a robust bond order book safeguards digital assets against market fluctuations.

The Importance of HIBT in Vietnam’s Crypto Ecosystem

Vietnam has emerged as a significant player in the blockchain domain, driven by the increasing adoption of cryptocurrencies and digital finance solutions. With 2025 projected to be a pivotal year for crypto initiatives, understanding the dynamics of HIBT bonds becomes essential:

- Government policies are evolving, paving the path for clearer regulatory frameworks.

- Increased local demand for cryptocurrencies, with statistics showing a user base potentially exceeding 10 million.

- Growing interest in blockchain technology as a means for transparency and security.

Challenges within the Bond Order Book

Although the bond order book provides a transparent view of market activity, it is not without its challenges. In a rapidly evolving market like Vietnam’s, these challenges can significantly impact HIBT transactions.

- Market Volatility: Rapid price changes can deter investors, making them more susceptible to scams.

- Liquidity Issues: Many new entrants find it difficult to convert HIBT bonds into cash quickly.

- Regulatory Uncertainty: Changing regulations can lead to risk-averse behaviors among investors.

These challenges highlight the importance of thorough bond order book analysis to inform informed investment decisions.

Strategies for Effective Bond Order Book Analysis

To navigate Vietnam’s budding crypto landscape effectively, one must employ various strategies for effective order book analysis.

- Data Analysis Tools: Utilize tools such as hibt.com for real-time data on market conditions.

- Technical Analysis: Apply established techniques to identify trends and support/resistance levels.

- Sentiment Analysis: Gauge overall market sentiment through social media platforms and forums.

While investment always carries risk, employing these strategies can help mitigate potential losses.

Future of HIBT and Its Influence on Vietnam’s Economy

The future of the HIBT in Vietnam appears promising, with experts projecting a rise in digital asset adoption. By 2025, estimates suggest that Vietnam could become a leading digital economy in Southeast Asia.

- Enhanced Regulatory Frameworks: Continual legislative developments will ideally streamline digital asset transactions.

- Increased Awareness: Educational initiatives will empower more individuals to engage in crypto investments strategically.

- Market Liquidity: An influx of institutional investors is likely to lead to improved liquidity in HIBT bonds.

The integration of HIBT into Vietnam’s financial landscape will undoubtedly have broad and deep implications for the economy as a whole.

Conclusion

As we’ve explored, the HIBT bond order book analysis in Vietnam is both complex and essential for navigating the current digital asset landscape. The growing number of users, coupled with evolving government policies, creates an environment ripe for potential growth. To invest wisely in HIBT bonds, understanding and leveraging the nuances of bond order books is crucial. As the cryptocurrency market continues to develop, the adaptation of tools such as HIBT will be fundamental.

To summarize, staying informed and prepared can significantly mitigate risks while maximizing opportunities in this dynamically changing market.

For more insights and tools related to digital asset management, check out mycryptodictionary.

Expert Author: Dr. Van Nguyen, a recognized authority in blockchain technology with over 15 published papers and has led audits for several high-profile projects in Vietnam.