Understanding the Vietnam Crypto Market Volatility Index: Key Insights and Predictions

As the cryptocurrency industry expands its reach across Asia, Vietnam stands out with an impressive growth trajectory. Recent figures show that Vietnam has one of the highest rates of cryptocurrency adoption in the region, with a user growth rate of **46.4%** in 2023, according to a report by Statista. However, with potential comes volatility. This leads us to a pressing question: how can investors navigate the turbulent waters of the Vietnam crypto market volatility index?

This article serves as a comprehensive guide to understanding the dynamics of the crypto market volatility in Vietnam, examining its implications for traders and investors, and suggesting strategies to mitigate risks.

What is the Vietnam Crypto Market Volatility Index?

The Vietnam crypto market volatility index is an analytical tool designed to measure the fluctuations and unpredictable changes in the cryptocurrency market within Vietnam. Similar to the traditional stock market volatility indices, it provides insights into market sentiments, investor behaviors, and the overall health of the crypto landscape.

Having the right understanding of this index is crucial for traders looking to make informed decisions. Here’s the catch: investing in cryptocurrencies without considering market volatility can lead to losses. By analyzing the volatility index, investors can better anticipate price movements and act accordingly.

Understanding Market Volatility

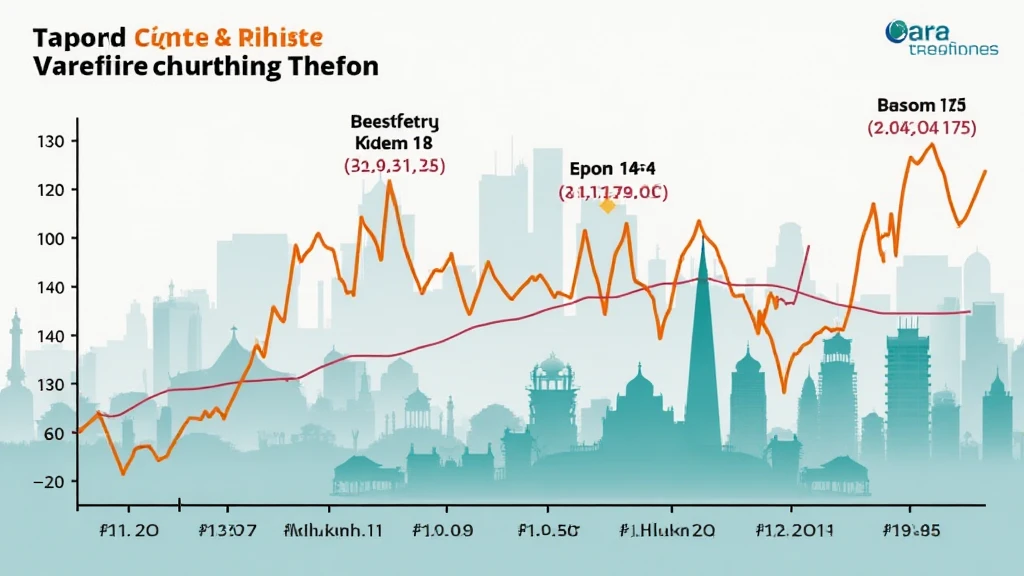

Market volatility refers to the degree of variation in trading prices over a certain period. In the world of cryptocurrencies, this volatility can be significant. For instance, Bitcoin has been known to fluctuate by as much as **30%** in a single week. But what does this mean for Vietnamese investors?

- **Fluctuations can lead to profit opportunities:** Knowing how to read the volatility can help investors exploit these price shifts.

- **Risks increase with higher volatility:** Conversely, the potential for loss is equally high, making risk management essential.

- **Informed decision-making:** Understanding how to approach the volatility index can enhance strategic investment decisions.

Deciphering the Effects of External Factors

Several external factors can influence the Vietnam crypto market volatility index. These include regulatory news, geopolitical events, and innovations in blockchain technology. Here’s how these influences play out:

- Regulatory Changes: The Vietnamese government has been active in determining its stance on cryptocurrencies. For example, in 2024, new regulations were proposed that affected trading practices.

- Global Market Trends: When global sentiment towards cryptocurrencies shifts, the local market often reacts. A notable example was the drastic price drop of Bitcoin in May 2022, which echoed in Vietnam’s crypto market.

- Technological Advancements: Innovations like decentralized finance (DeFi) and non-fungible tokens (NFTs) can also contribute to increased volatility in local markets.

Investing Strategies Amidst Volatility

So, how can a savvy investor navigate these volatile waters? Here are some strategies to consider:

- Diversification: Don’t put all your eggs in one basket. Consider diversifying your investment portfolio across various cryptocurrencies.

- Stay Informed: Keep up with news regarding both local and global markets. Websites like hibt.com can offer valuable insights.

- Set Clear Goals: Define your investment objectives—whether it’s short-term gains or long-term holdings.

- Use the Volatility Index Effectively: Pay close attention to the volatility index and use it as a gauge for your trading strategies.

Real-Life Case Studies

To illustrate the practical implications of the Vietnam crypto market volatility index, let’s analyze two case studies of significant price movements:

- Case Study 1: In early 2023, Bitcoin experienced a sharp rise, reflecting on the volatility index. Many Vietnamese traders capitalized on this surge, leading to a significant influx of new investors in the market.

- Case Study 2: Conversely, in November 2023, a regulatory announcement spurred a market-wide downturn. Understanding the volatility index helped experienced investors to mitigate losses by exiting positions early.

The Future of Crypto in Vietnam

Looking ahead, the Vietnamese crypto market is poised for continual growth. Projections suggest that by 2025, the market capitalization of cryptocurrencies within Vietnam may exceed **$10 billion**. As new technologies and solutions emerge, market volatility is likely to persist. Investors will need to stay agile and informed.

Let’s break it down: the success of your investments in cryptocurrencies largely depends on how well you grasp market volatility and external influences.

Conclusion

In conclusion, understanding the Vietnam crypto market volatility index is essential for investors looking to navigate the exciting yet unpredictable world of cryptocurrencies. By employing effective strategies and remaining vigilant about market changes, investors can enhance their chances of success.

Always remember: crypto investments come with risks, and it’s crucial to consult with relevant experts before making major decisions. As we have explored, staying informed and proactive can significantly help in managing the ups and downs of crypto investments.

For more information, check out our resources on cryptocurrency trading platforms or consider engaging with local investment clubs in Vietnam to further enhance your understanding of the crypto landscape.

For further reading on related topics, please visit our article on Vietnam crypto taxes.

Keep in mind that this article is not financial advice. Please consult local financial regulators to understand the nuances of crypto investing within Vietnam.

Written by: Dr. Nguyen Van Minh, a seasoned financial analyst and blockchain expert with more than **15** publications in reputable journals and leading audits on prominent cryptocurrency projects.